Zona de Azar UK – International Game Technology PLC Reports First Quarter 2021 Results

UK.- May 12th 2021 www.zonadeazar.com International Game Technology PLC yesterday reported financial results for the first quarter ended March 31, 2021. Yesterday, at 8:00 a.m. EDT, management hosted a conference call and webcast to present the results; access details are provided below.

IGT is the global leader in gaming. We enable players to experience their favorite games across all channels and regulated segments, from Gaming Machines and Lotteries to Interactive and Social Gaming. Leveraging a wealth of premium content, substantial investment in innovation, in-depth customer intelligence, operational expertise and leading-edge technology, our gaming solutions anticipate the demands of consumers wherever they decide to play. We have a well-established local presence and relationships with governments and regulators in more than 100 countries around the world, and create value by adhering to the highest standards of service, integrity, and responsibility. IGT has more than 13,000 employees. For more information, please visit www.merger.igt.com.

“We delivered some of our strongest profit results ever during the first quarter, fueled by robust player demand and significant, structural cost savings,” said Marco Sala, CEO of IGT. “Our Global Lottery segment achieved record same-store sales levels on impressive increases around the world. The Global Gaming segment is demonstrating swift, progressive recovery, including accelerated momentum for Digital & Betting activities. We expect to return to 2019 levels for key financial metrics this year.”

“With the recovery in our business in full swing, we are delivering strong operating leverage which, when coupled with invested capital discipline, drove strong cash flows in the quarter,” said Max Chiara, CFO of IGT. “This enabled us to accelerate our debt retirement strategy and gives us confidence in a return to pre-pandemic leverage levels by the end of the current year.”

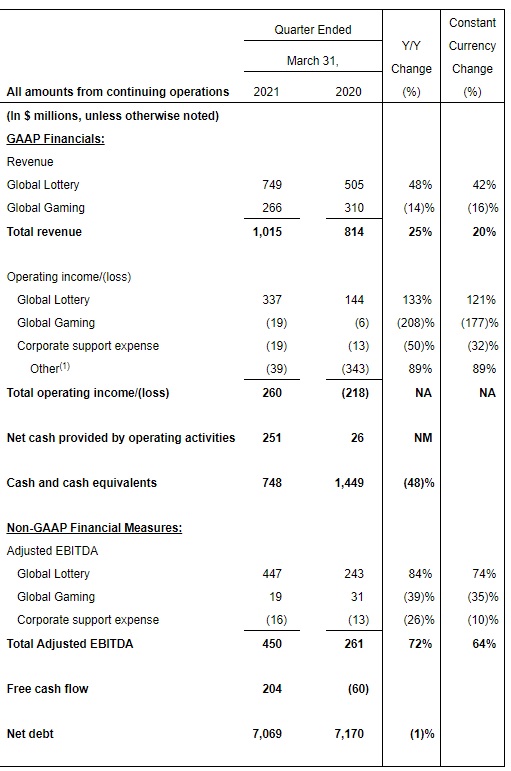

Overview of Consolidated First Quarter 2021 Results

(1) Primarily includes purchase price amortization and goodwill impairment

Note: Reconciliations of non-GAAP financial measures to the most directly comparable GAAP financial measures are provided at the end of this news release

Key Highlights:

Achieved among highest revenue and profit levels in Company history, fueled by Global Lottery

Delivered strong cash flow driven by performance and invested capital discipline; return to pre-pandemic leverage expected by end of the year

Achieved ~1/3 of $200M+ 2021 OPtiMa savings targets during the first quarter

Sequential improvement in Global Gaming as industry recovers from pandemic-driven restrictions; growth in Digital & Betting continues with 85% year-over-year increase in revenue in the quarter

Successfully refinanced ~$1.0 billion in 6.25% Notes due 2022 with $750 million 4.125% Notes due 2026 and draws on revolving credit facilities

Signed seven-year contract extension with Jamaica Lottery; four-year iLottery contract extension with Kentucky Lottery; two-year contract extension with Mexico Lottery

Financial highlights:

Consolidated revenue of $1,015 million, up 25% from the prior year

Global Lottery revenue of $749 million, up 48%, driven by 32.4% growth in same-store sales

Global Gaming revenue totals $266 million, versus $310 million in the prior year; up sequentially from $255 million in Q4’20 as U.S. gaming markets continue to recover

Operating income of $260 million, compared to operating loss of $218 million in the prior year

Global Lottery same-store sales growth translates into high profit flow-through

Benefits from OPtiMa structural cost-savings

Goodwill impairment of $296 million in prior-year period

Net interest expense of $94 million compared to $100 million in the prior year

Provision for income taxes of $148 million, compared to a benefit from income taxes of $1 million in the prior year

Higher valuation allowances on deferred tax assets in the current period

Income taxes paid of $4 million versus $11 million in the prior year

Net income attributable to IGT was $92 million versus a net loss attributable to IGT of $248 million in the prior-year period

After-tax goodwill impairment of $296 million in prior-year period

Higher non-cash foreign exchange gains, primarily on Euro-denominated debt instruments, in the current period

Net income per diluted share of $0.38 compared to a net loss per diluted share of $1.28 in the prior year

Adjusted EBITDA of $450 million compared to $261 million in the prior-year period; Global Lottery achieves among the highest segment-level Adjusted EBITDA

Net debt of $7.07 billion compared to $7.32 billion at December 31, 2020; Net debt to LTM Adjusted EBITDA of 5.40x, down from 6.39x at December 31, 2020, driven by strong financial results and cash flow generation

Cash and Liquidity Update

Total liquidity of $2.1 billion as of March 31, 2021; $748 million in unrestricted cash and $1.4 billion in additional borrowing capacity

Other Developments

As previously announced, completed sale of Italy B2C gaming businesses on May 10, 2021; net proceeds to partially fund full redemption, by make-whole call, of €850 million 4.75% Senior Secured Euro Notes due February 2023

In March 2021, issued $750 million 4.125% Notes due 2026, as previously announced

Net proceeds used to fund redemption of 6.25% Notes due 2022

Lowest USD-denominated coupon ever issued by the Company

Recast historical financial information for Q2’20 and Q3’20 included at the end of this release

Conference Call and Webcast:

May 11, 2021, at 8:00 a.m. EDT

Live webcast available under “News, Events & Presentations” on IGT’s Investor Relations website at www.IGT.com; replay available on the website following the live event

Dial-In Numbers

US/Canada toll-free dial-in number: +1 844 842 7999

Outside the US/Canada toll-free number: +1 612 979 9887

Conference ID/confirmation code: 6783961

A telephone replay of the call will be available for one week

US/Canada replay number: +1 855 859 2056

Outside the US/Canada replay number: +1 404 537 3406

ID/Confirmation code: 6783961

Note: Certain totals in the tables included in this press release may not add due to rounding

Comparability of Results

All figures presented in this news release are prepared under U.S. GAAP, unless noted otherwise. Adjusted figures exclude the impact of items such as purchase accounting, impairment charges, restructuring expense, foreign exchange, and certain one-time, primarily transaction-related items. Reconciliations to the most directly comparable U.S. GAAP measures are included in the tables in this news release. Constant currency changes for 2021 are calculated using the same foreign exchange rates as the corresponding 2020 period. Management uses non-GAAP financial measures to understand and compare operating results across accounting periods, for internal budgeting and forecasting purposes, and to evaluate the Company’s financial performance. Management believes these non-GAAP financial measures reflect the Company’s ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of business trends. These constant currency changes and non-GAAP financial measures should however be viewed in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with U.S. GAAP.

Edited by: @MaiaDigital www.zonadeazar.com