Zona de Azar USA – North Carolina: Governor Seeks Changes to Gambling Winnings Tax Law

USA.- May 2, 2024 www.zonadeazar.com Sports bettors in North Carolina must pay state income taxes on their winnings, but cannot deduct their losses to lessen the tax bill under current law.

USA.- May 2, 2024 www.zonadeazar.com Sports bettors in North Carolina must pay state income taxes on their winnings, but cannot deduct their losses to lessen the tax bill under current law.

Gov. Roy Cooper called for state lawmakers to remedy that situation, which could become an issue with the legalization of mobile sports betting across the state in March.

“When it comes to sports wagering, it’s not fair to have to pay taxes on your winnings without being able to deduct your losses,” Cooper said on social media. Cooper was a supporter of legalization. “Legislators should fix this.”

Under current law, if bettor won $1,000 gambling but lost $5,000, the bettor would be responsible for taxes on the $1,000 in winning. Any change is not likely to let you deduct losses from your other income, but simply use losses to negate tax payments on winnings.

Rep. Jason Saine, R-Lincoln County and a top sponsor of the sports betting legislation, told WRAL that he and some other lawmakers have tried to make the change in the past. But that “it would probably be more palatable now.”

That’s because it could impact lots of people in the state.

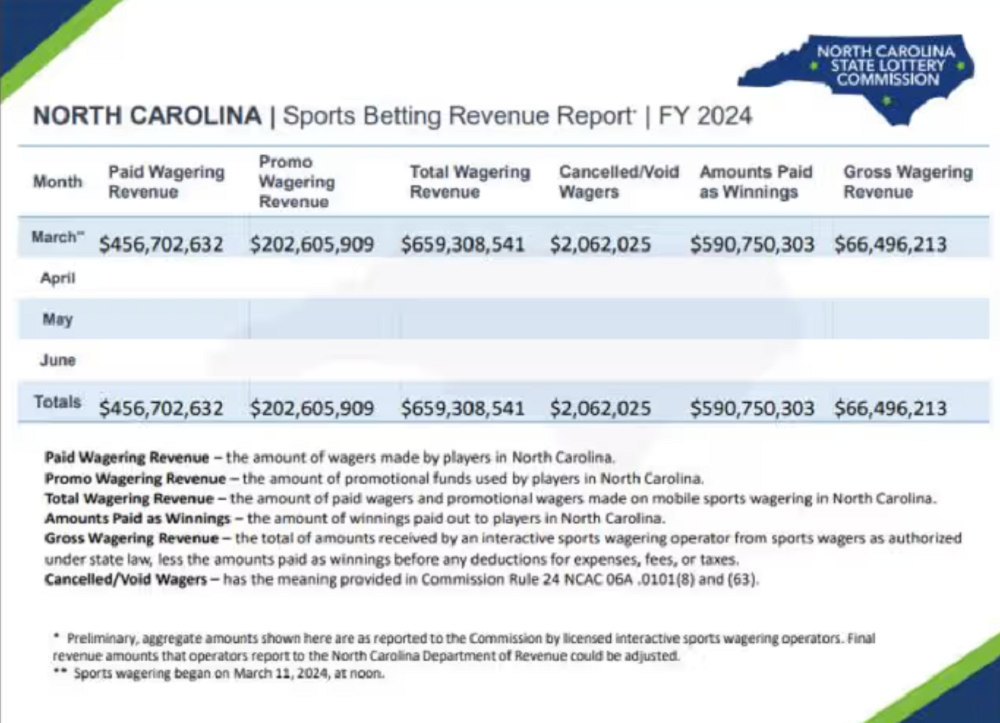

In March, bettors in the state wagered nearly $660 million, including promotional bets, on the eight licensed sports betting apps. Gamblers won $590 million, but the operators took in more than $66 million.

NC State economist Nathan Goldman told WRAL in April that gambling winnings have always been considered taxable income. But sports betting apps make it easier for everyone to track how much you’ve made.

“Once you exceed $600, you will receive a W-2G in the mail,” Goldman said. “This is gonna be just like any other document that you get from like your employer or from a brokerage if you have some investments.”

For those who don’t win at least $600 with any one sportsbook, you’re still expected to pay taxes on your winnings.

“You’re required to self-report it,” Goldman told WRAL. “Whether or not you do it is up to you. And I suspect a lot of taxpayers will probably err on the side of not reporting it. But that’s not what the law says.”

Edited by: @MaiaDigital www.zonadeazar.com