Zona de Azar USA – Realty Income Confirms $1.7bn Encore Boston Harbor Land & Real Estate Purchase

USA.- December 5th 2022 www.zonadeazar.com Wynn Resorts has confirmed the finalised sale of the land and real estate assets of Encore Boston Harbor to Realty Income Corporation for $1.7bn in cash, representing a cash cap rate of 5.9 per cent.

USA.- December 5th 2022 www.zonadeazar.com Wynn Resorts has confirmed the finalised sale of the land and real estate assets of Encore Boston Harbor to Realty Income Corporation for $1.7bn in cash, representing a cash cap rate of 5.9 per cent.

Following the sale, the casino and entertainment group will continue to operate the integrated resort and enter into a triple net lease arrangement with the real estate investment trust.

This will have an initial total annual rent of $100m and a term of 30 years, with one thirty-year tenant renewal option. Rent will escalate at 1.75 per cent for the first ten years, and the greater of 1.75 per cent and the CPI increase during the prior year (capped at 2.5 per cent) over the remainder of the initial lease term.

Craig Billings, CEO of Wynn, had previously noted that the proceeds of the transaction would provide liquidity for upcoming development projects, with it added that it also offers the potential to further strengthen the company’s global liquidity position to $4.4bn.

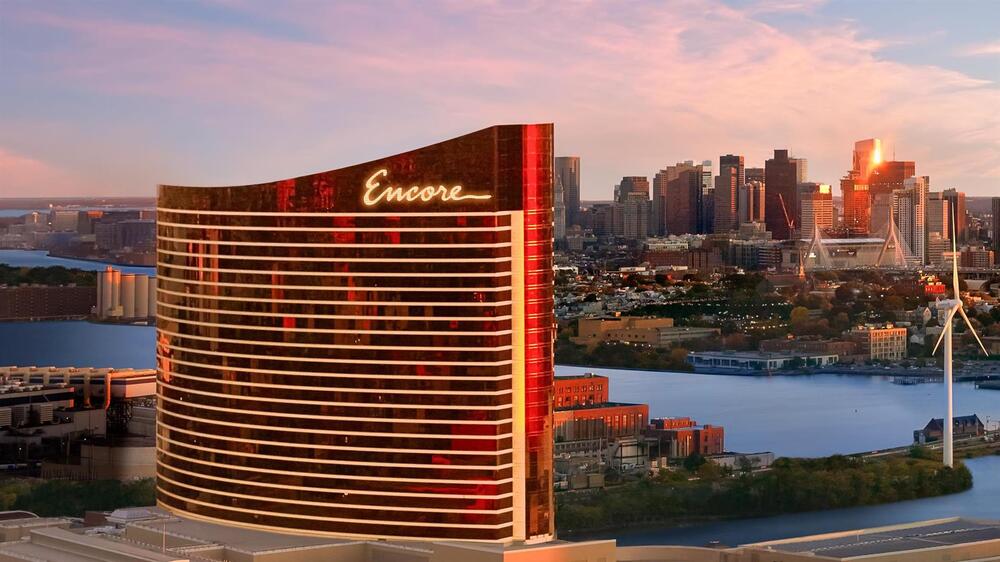

Encore Boston Harbor, located on the Mystic River less than five miles from downtown Boston, debuted to much fanfare in June 2019 at a cost of $2.6bn.

When the deal was first disclosed in February, Wynn said that it would retain a 13-acre plot of developable land upon which it plans to construct an expansion that includes additional covered parking along and non-gaming amenities.

Sumit Roy, Realty Income’s president and chief executive officer, commented when the deal was announced: “This transaction demonstrates our ability to utilise our platform and scale to acquire prime real estate assets across a variety of industries in alignment with our investment criteria.

“Our investment philosophy centres around generating favourable risk-adjusted returns by investing in strategically important properties with partners who are leaders in their respective industries.

“We are pleased to cultivate a new relationship with Wynn Resorts as we expand our universe of net lease investments.”

Edited by: @MaiaDigital www.zonadeazar.com