Zona de Azar USA – AGEM Index Rises 7% in July 2024, Led by Aristocrat Leisure and IGT

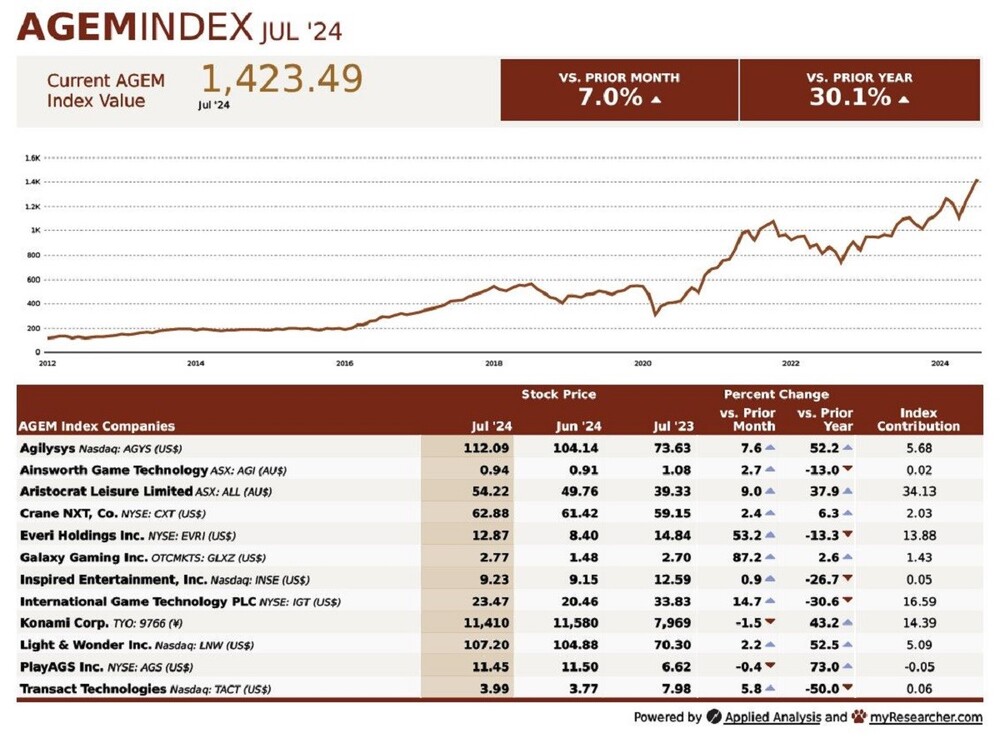

USA.- August 6, 2024 www.zonadeazar.com The AGEM Index increased by 93.30 points to 1,423.49 in July 2024, a 7.0 percent increase from the prior month.

USA.- August 6, 2024 www.zonadeazar.com The AGEM Index increased by 93.30 points to 1,423.49 in July 2024, a 7.0 percent increase from the prior month.

Compared to one year ago, the index climbed 30.1 percent, or 329.33 points. During the latest month, 10 of the 12 AGEM Index companies reported stock price increases, which resulted in 11 positive contributions and one negative contribution to the AGEM Index.

The largest positive contributor to the monthly index was Aristocrat Leisure Limited (ASX: ALL), whose 9.0 percent increase in stock price led to a 34.13-point gain to the index. Meanwhile, International Game Technology PLC (NYSE: IGT) saw its stock price increase by 14.7 percent, leading to a 16.59-point gain for the index.

The lone negative contributor to the index was PlayAGS Inc. (NYSE: AGS), whose 0.4 percent decrease in stock price resulted in a 0.05-point loss to the AGEM Index.

As of July 2024, the AGEM Index has experienced 16 consecutive months of positive year-over-year growth with all but one of the periods showing double-digit growth. Over this period, the index grew by 46.5 percent, or 451.97 points. This marked the longest period of sustained growth since November 2020 to April 2022, when the index experienced positive year-over-year growth for 18 consecutive months.

In July, two of the three major U.S. stock indices decreased from the prior period. The NASDAQ fell by 3.2 percent over the month, while the S&P 500 fell by 0.6 percent. At the same time, the Dow Jones Industrial Average increased by 2.7 percent from the prior month.

The AGEM Index

The Association of Gaming Equipment Manufacturers (AGEM) produces the monthly AGEM Index that comprises 12 global gaming suppliers throughout the world. A total of nine suppliers are based in the United States and are listed on the NYSE, Nasdaq or OTC market, while two trade on the Australian exchange and one on the Tokyo exchange. The index is computed based on the month-end stock price (adjusted for dividends and splits) of each company and weighted based on approximation of market capitalization.

Market capitalizations for manufacturers trading on foreign exchanges have been converted to US dollar-equivalents as of month-end for comparability purposes. The AGEM Index is based on a 100-point value as of January 2005. Company stock prices and AGEM Index contributions may be revised as necessary due to stock splits, reverse stock splits, mergers, acquisitions and other business activities.

Edited by: @MaiaDigital www.zonadeazar.com