3 UK Gambling Trends & Insights From Optimove

Israel.- 16th July 2025 www.zonadeazar.com The May 2025 report analyzes data from over 6.2 million players across Europe, including the UK, to benchmark player behavior and performance trends in online gambling. Here’s a snapshot of the full report.

Why it Matters:

Optimove Insights is the analytical and research division of Optimove, the #1 CRM Marketing Solution for iGaming and Sports Betting. The iGaming Pulse equips operators with behavioral benchmarks, helping them navigate acquisition, retention, and engagement across key markets.

For UK operators, this month’s data offers a strategic window into how changing compliance rules actively reshape player behavior and where smart CRM strategy can turn this shift into an opportunity.

Key takeaways:

The May 2025 pulse report examines online gambling in the UK and benchmarks UK players against 6.2 million others across Europe. In May, the UK had lower deposits and bets than other countries, but player habits started to change, likely due to regulatory changes.

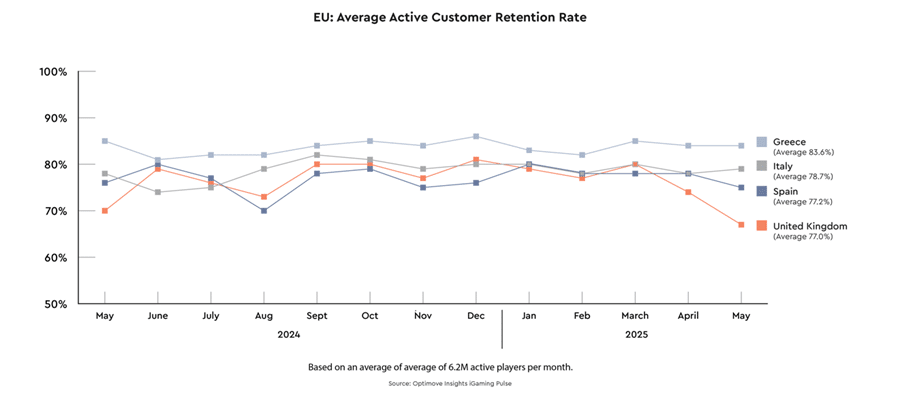

1. UK Retention Rate Slips

In May 2025, the UK’s active player retention dropped sharply to 66.9%, down from a trailing 12-month average of 77%. This marks the lowest monthly retention rate over the past year.

The decline is closely linked to stricter compliance requirements that came into effect, such as:

- Tighter affordability checks

- Enhanced Know Your Client (KYC) protocols

- Reduced promotional allowances

What it means to operators: While some casual players may have churned, the dip in retention highlights the importance of timely, relevant engagement strategies to sustain loyalty under new conditions.

See more details in the chart below:

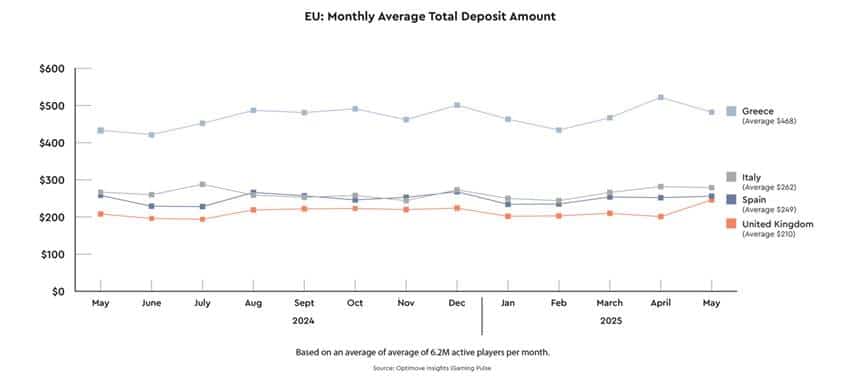

2. Higher Deposit Amounts

Amid retention challenges, average deposit amounts increased by 17%, from a 12-month average of $210 to $246 in May. This suggests that players who stayed active demonstrate higher value and intent.

What it means to operators: The newly retained player base may be smaller but more active and committed, creating a strong case for focusing on high-value segments and using real-time personalization to maximize loyalty lifetime value.

See more details in the chart below:

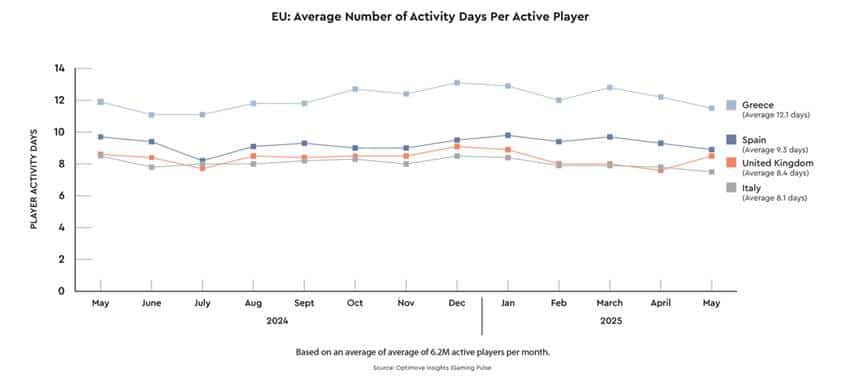

3. Increase in Engagement (User Active Days)

The month of May also saw an upward tick in engagement. Average activity days per active UK player rose from 8.4 to 8.5, a modest gain, but a signal that retained players are engaging more frequently under the new regulatory landscape.

What it means to operators: With the right journey orchestration capabilities, operators can capitalize on this momentum to drive deeper engagement, such as in-app messages triggered by behavior patterns or event-based journey automation.

See more details in the chart below:

Takeaways: What Operators Can Learn from the UK Data

The UK market is evolving rapidly; here’s how to turn this data into action:

Personalize Meaningfully – As mass promos diminish under regulation, operators who personalize with purpose will win. Use AI to tailor messages by preference, spend behavior, channel, and other relevant factors.

Segment Smarter – Focus on high-value, high-engagement players who’ve remained post-regulation. Create predictive segments to identify those likely to churn and act fast with personalized marketing campaigns and retention strategies.

Orchestrate Responsively – Trigger real-time engagement when players increase deposits or return after inactivity. Don’t wait for campaign cycles; use real-time behavioral data to guide the next best action.

In Summary

Though the UK market is experiencing a regulatory reset, the data shows the players who remain active are more valuable and engaged. For operators, this presents an opportunity to invest in smarter segmentation, agile orchestration, and meaningful personalization to turn these players into loyal, long-term customers.

Visit Optimove Insights iGaming Pulse for the full report.

For more insights into player trends, contact us to request a demo.

Edited by: @MaiaDigital www.zonadeazar.com