Zona de Azar USA – Third Quarter 2022: Commercial Gaming Revenue Surges Past $15 Billion Milestone

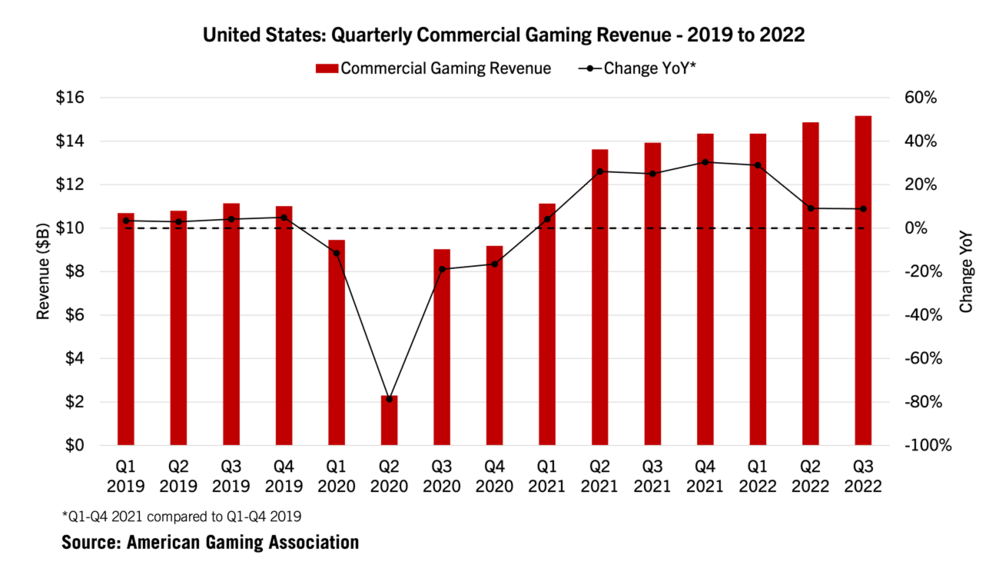

USA.- November 10th 2022 www.zonadeazar.com U.S. commercial gaming revenue reached an all-time high in the third quarter, topping $15 billion for the first time.

USA.- November 10th 2022 www.zonadeazar.com U.S. commercial gaming revenue reached an all-time high in the third quarter, topping $15 billion for the first time.

Despite macroeconomic pressure and tough year-over-year comparisons, consumer spending on gaming entertainment was resilient, keeping the industry on course for a second consecutive record-breaking year.

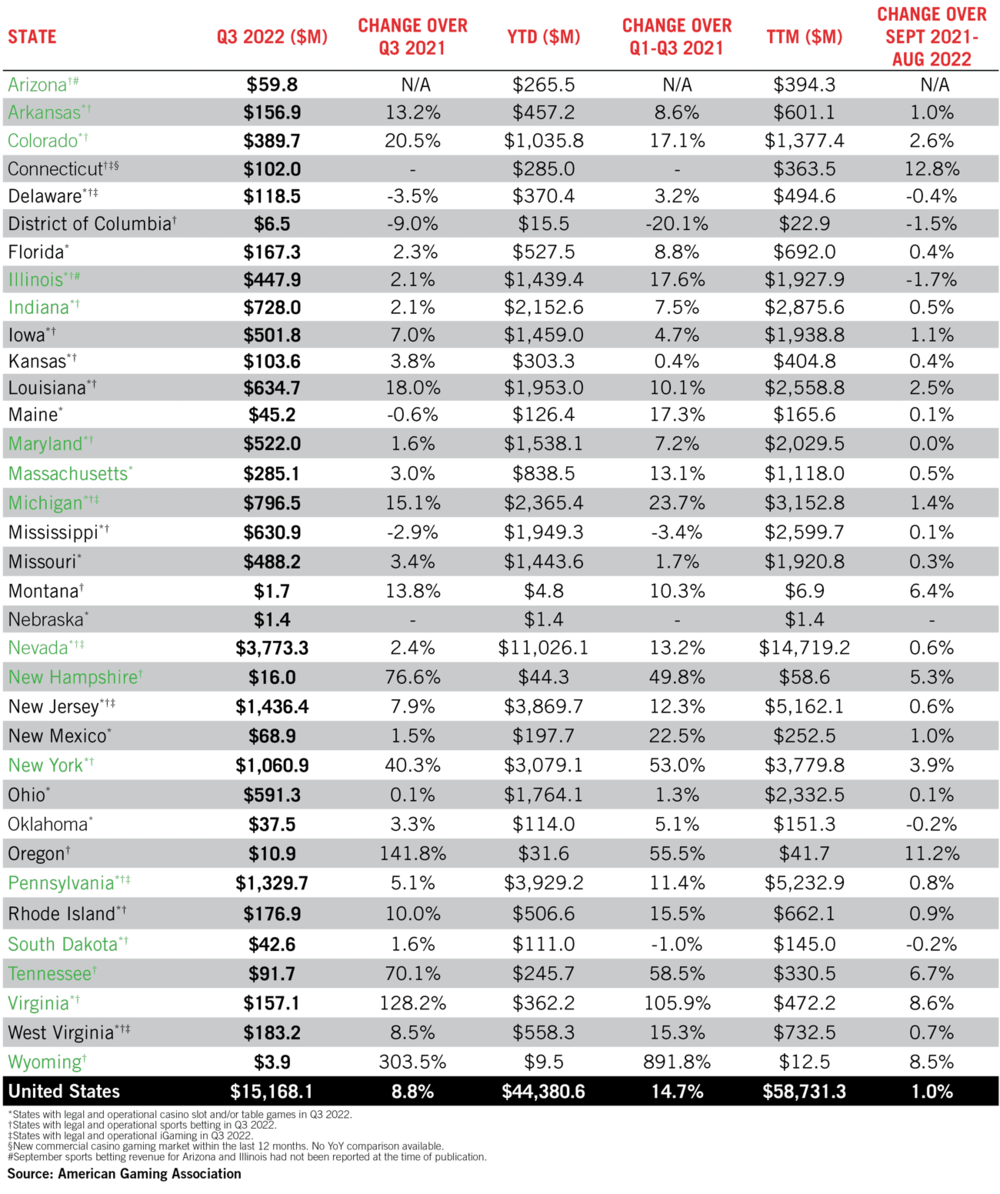

Revenue data reported by state regulators and compiled by the AGA shows that nationwide commercial gaming revenue from traditional casino games, sports betting and iGaming reached $15.17 billion in the third quarter, up two percent from the previous record set in the second quarter of this year.

Despite having two fewer weekend days than last year, third quarter gaming revenue accelerated 8.8 percent year-over-year, outpacing the broader U.S. economy’s 2.6 percent growth rate.

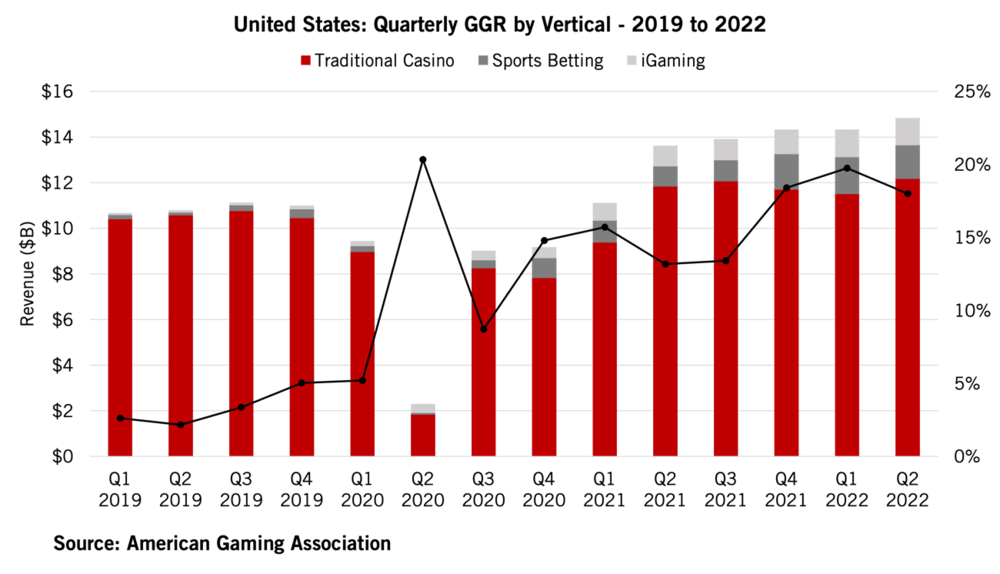

Gaming revenue grew year-over-year across all verticals, with slots, table games and sports betting generating all-time quarterly records. Combined revenue from slot machines and table games at casinos was $12.27 billion, or 80.9 percent of total commercial gaming revenue, while sports betting grossed $1.68 billion (11.1% of total) and iGaming $1.21 billion (8.0% of total).

Together, sports betting and iGaming combined for $2.89 billion in quarterly revenue, comprising 19.1 percent of total gaming revenue, up from an 18.1 percent share in Q2 but lower than the 19.7 percent captured in Q1.

After three very strong quarters, 2022 will almost certainly be gaming’s strongest year ever. Year-to-date revenue of $44.38 billion, is 14.7 percent ahead of the same period last year.

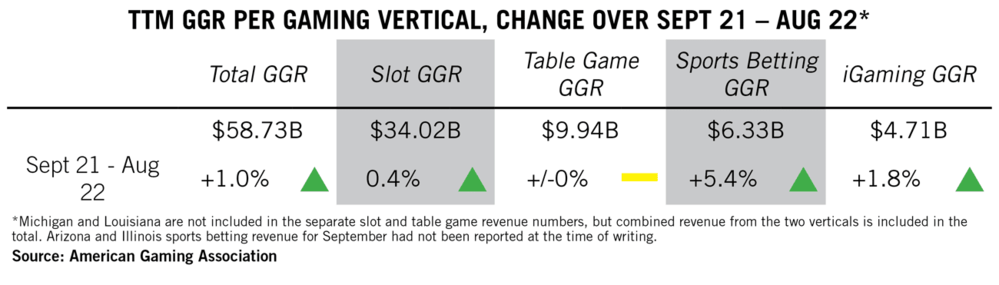

Meanwhile, trailing 12 month (TTM) revenue, covering the past twelve consecutive months from Oct 2021 through Sep 2022, was $58.73 billion. TTM is a measurement that is both current and seasonally adjusted. Gaming revenue over the last 12 consecutive months was up one percent from the preceding TTM period (Sept 2021-Aug 2022).

Sixteen States Set Quarterly Record, 24 On Pace for Record Year

At the state level, 29 of 33 commercial gaming jurisdictions that were operational one year ago increased Q3 revenue from 2021. Sixteen states (in green below) marked all-time records for a single quarter, including five of the country’s six largest commercial gaming markets: Indiana ($728.0M), Michigan ($796.5M), Nevada ($3.77B), New York ($1.06B) and Pennsylvania ($1.33B).

Quarterly revenue contracted in four jurisdictions compared to Q3 2021 as Delaware, Maine and Mississippi reported minor drops of between 0.6 and 3.5 percent, while the small sports betting-only market in Washington, D.C. continued to lose ground to neighboring Maryland and Virginia.

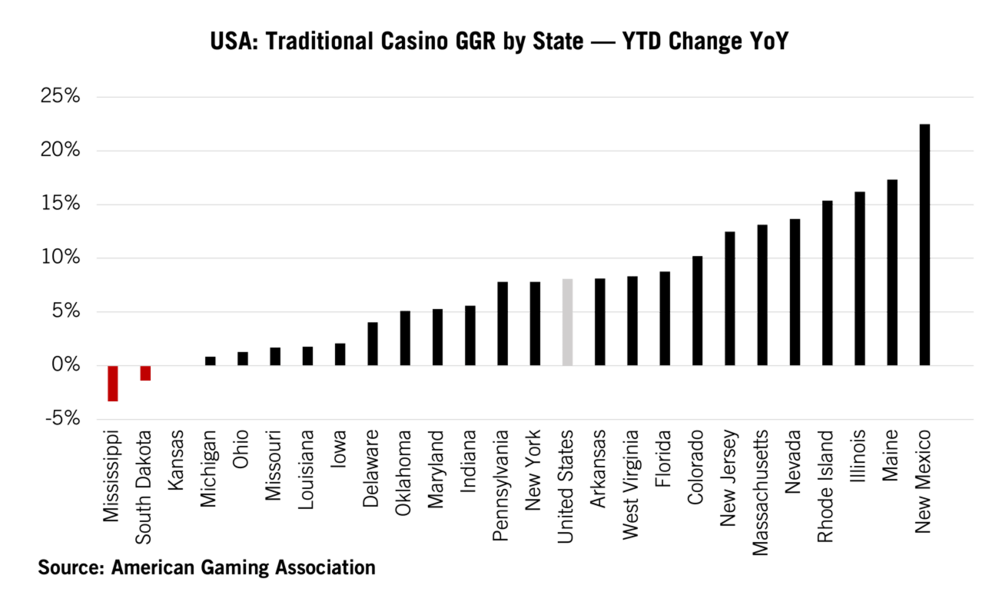

Through September, nearly all states remain on track to exceed 2021 revenue totals, with only three jurisdictions trailing last-years performance through Q3: Washington, D.C. (-20.1%), Mississippi (-3.4%) and South Dakota (-1.0%). Twenty-four of 30 jurisdictions that were operational throughout 2021 are so far outpacing their respective revenue record for a full calendar year.

Land-Based Casinos Mark Quarterly Record

U.S. land-based casino slot and table games generated a quarterly revenue record of $12.27 billion, up 1.8 percent year-over-year and an 0.8 percent sequential gain. Closing out the quarter, September had the fastest growth rate for land-based casino revenue—4.2 percent—since April, reflecting sustained consumer demand for in-person gaming.

Growth rates for table and slot revenue have converged after more than a year of table game growth significantly outpacing slots. Revenue generated by table games reached $2.55 billion in Q3, up 2.4 percent year-over-year, while slot revenue increased at a pace of 1.7 percent to $8.84 billion. The separate slot and table game figures do not include data from Louisiana and Michigan, though their aggregates are captured by the combined nationwide figure.

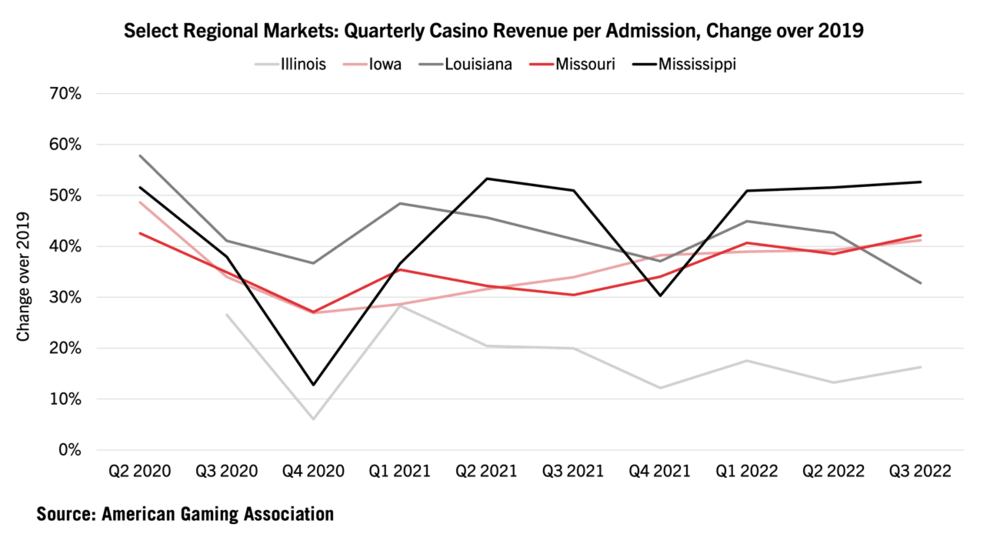

The historically strong quarter for traditional gaming revenue continues to be driven by higher spending from fewer visitors in the states that publish admissions data. Quarterly revenue per admission remained well above pre-pandemic levels in each of these states—37.0 percent on average —and was near Covid-era highs in Iowa, Mississippi and Missouri.

Third quarter land-based gaming revenue was also helped by the launch of commercial casino gaming in two new states. Virginia became America’s 26th state when commercial land-based casino gaming began at Hard Rock Bristol on July 8. The first temporary location grossed $40.3 million in its inaugural quarter of partial operations, outperforming several similarly sized properties in nearby Maryland, Pennsylvania and West Virginia. On September 24, Nebraska became the 27th such market with the debut of slot gaming at WarHorse Casino in Lincoln.

At the state level, 17 of 25 states that had land-based casino gaming in 2021 increased Q3 traditional gaming revenue this year.

Through September, year-to-date revenue from land-based casino slot machines and table games stands at $35.90 billion, 8.1 percent ahead of the same period in 2021. Twenty-two of 25 states saw annual revenue growth from traditional gaming through the first nine months of 2022.

Historic Sports Betting Hold Powers Record Quarter

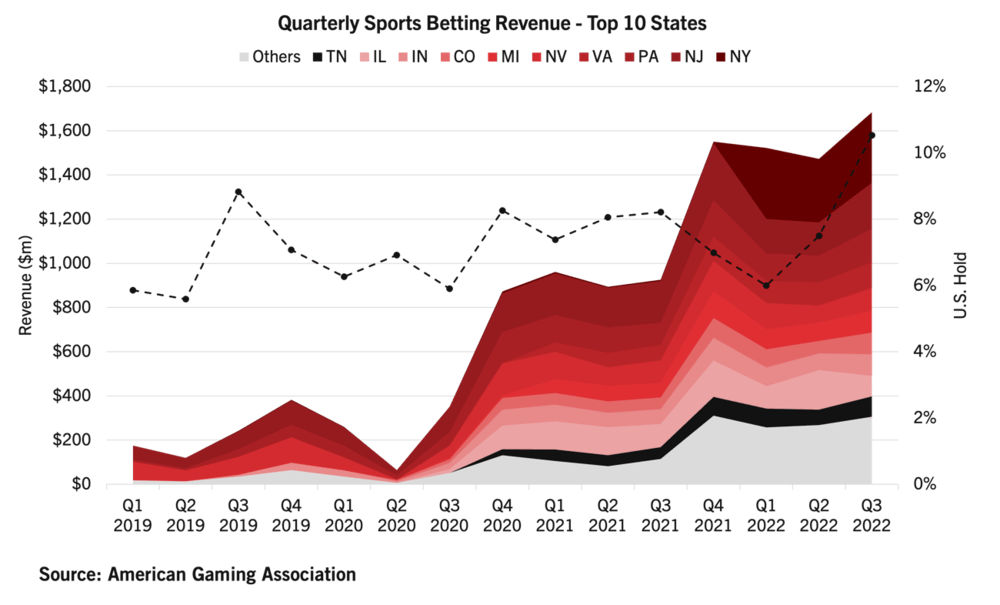

While land-based performance drove overall gaming revenue, sports betting and iGaming continued to see tremendous growth in the third quarter as sportsbooks enjoyed a record hold percentage. Meanwhile, iGaming revenue nearly matched the Q2’s quarterly record.

Americans bet $15.99 billion on sports in the third quarter, accelerating by 40.9 percent year-over-year. This is a result of continued growth in wagering activity across 15 of 20 markets with betting throughout all of Q3 2021, the addition of seven new markets since September 2021, as well as mobile betting options in New York.

Nationwide sports betting revenue reached a record $1.68 billion, surpassing the previous quarterly high set in Q1 2022 ($1.62B) and jumping 80.6 percent year-over-year. Excluding the new markets and New York mobile betting, Q3 2022 saw sports betting revenue increase 33.3 percent from a year ago. Sportsbook hold was 10.5 percent for the quarter, up from 7.5 percent in Q2 and 6.0 percent in Q1.

Year to date commercial sports betting revenue reached $4.78 billion, up 71.4 percent from the same period last year, as Americans wagered $62.67 billion through the end of Q3.

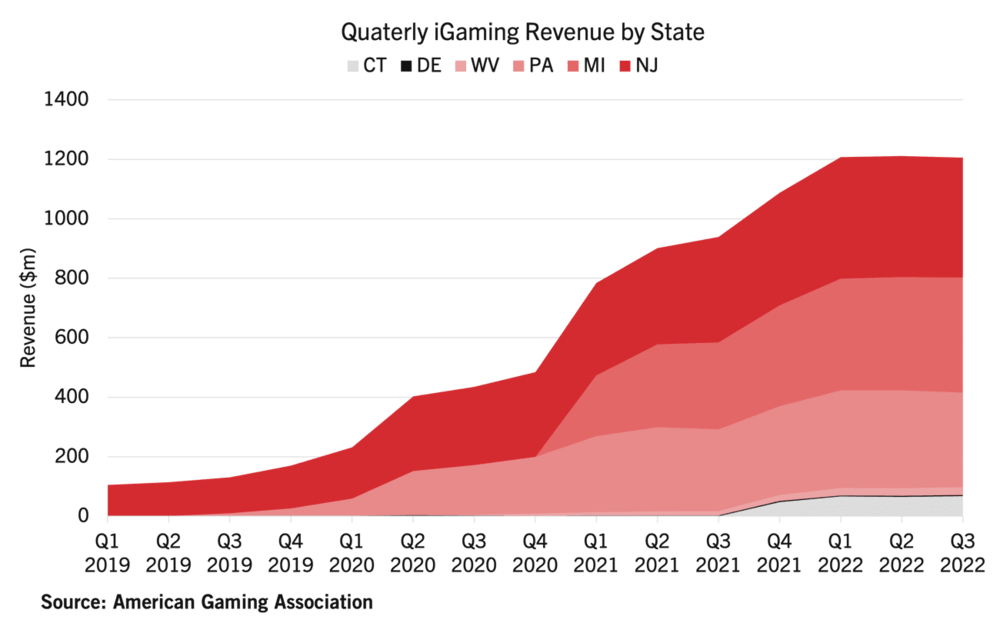

iGaming also extended its growth into the third quarter, generating nearly $1.21 billion in revenue, or an increase of 28.5 percent year-over-year and less than one percent shy of the quarterly record set in Q2. Six iGaming markets were live this quarter compared to five in 2021 (excluding Nevada online poker). Omitting the less-than-one-year-old Connecticut market, iGaming revenue was up 21.3 percent year-over-year.

Like the other commercial gaming verticals, 2022 has seen the strongest first three quarters for a year with year-to-date iGaming revenue at $3.62 billion through Q3, an increase of 38.1 percent from the same period in 2021.

Edited by: @MaiaDigital www.zonadeazar.com