Zona de Azar Germany – IDnow: How LATAM Gambling Operators Plan to Meet Age-Old Compliance Challenges

Germany.- June 7th 2024 www.zonadeazar.com IDnow unpacks its ‘Challenges in Compliance Survey’ and reveals the different priorities of global and Latin American operators.

Germany.- June 7th 2024 www.zonadeazar.com IDnow unpacks its ‘Challenges in Compliance Survey’ and reveals the different priorities of global and Latin American operators.

The gross gaming revenue (GGR) of the Latin American (LATAM) gambling market is projected to exceed $3.4 billion by the end of 2025. Considering the GGR in 2020 was just $1.3 billion, this is a huge leap.

There are many reasons for LATAM’s projected rapid growth, including the opening of multiple lucrative markets and simply the sheer number of potential players.

Besides Colombia, which has had relatively clear regulation since 2016, many Latin American countries are either in their infancy or gestation phases, meaning they have a valuable opportunity to learn from the mistakes and successes that established markets have already made.

To understand the challenges facing gambling operators, new and old, we commissioned the ‘Challenges in Compliance Survey’, featuring insights and opinions from 104 global compliance professionals from the gambling industry. Respondents were a mixture of the old guard, including the UK, Malta and Germany to the new like Brazil, Peru and Chile. In this blog we explore the differences in responses between global players and LATAM operators and consider the reasons.

Top compliance concerns for LATAM operators.

In answer to the question, ‘How challenging for your business are the following compliance issues’, there did appear to be consensus on the most difficult issue, with 30% of LATAM operators and 22.73% of global respondents choosing the ‘Source of funds check’ option.

One of the most interesting, but perhaps unsurprising compliance challenges for LATAM (considering its ever-changing regulatory landscape) was ‘Staying up to date with regulatory changes’, with more than one in five (22.2%) saying it was the most difficult challenge, compared to just 6% of global respondents.

The other stark difference in responses was the 22.2% of LATAM respondents that cited ‘Licensing and permissions’ as the most difficult compliance challenge, compared to just 7.58% of global respondents.

“With the LATAM gambling market so early in its journey toward regulation, it’s understandable that almost half of LATAM respondents list regulatory concerns and licensing and permission as their most difficult compliance challenges. From rates of taxation and anti-money laundering policies to licensing requirements and responsible gambling measures, each country is approaching issues slightly differently.

As many LATAM countries are at a similar stage, there is also a very real game of ‘let’s wait to see what our neighbors are doing’ being played out. A game of chicken, if you will, of who’ll move first and what path will they take.

Ronaldo Kos, Head of LATAM Gaming at IDnow.

The global impact of fraud.

When asked which types of fraud they had been subjected to in the last 12 months, there were negligible differences between responses, with bonus abuse (Global: 65.57% LATAM: 70%) and document fraud (Global: 57.38% LATAM: 50%) the two most common fraud attacks.

Interestingly, operators based in LATAM said that they had not been subjected to any money laundering in the last 12 months, whereas almost one in five global operators (19.67%) said they had. Whether this is indicative of fewer Latin American money launderers or less robust AML controls in LATAM gambling platforms is up for debate.

Regarding the next 12 months, respondents cited both ‘Bonus abuse’ (Global: 54.10%, LATAM: 80%) and ‘Social engineering’ (Global: 54.10%, LATAM: 60%) as the top areas for concern.

AI and the different approaches in fighting fraud and optimizing onboarding.

As gambling operators scale and look for ways to expand their business, especially during periods of increased activity, many have implemented AI-based tools to help in their fight against fraud, but perhaps not as many as you think.

In fact, despite AI’s ability to increase automation, reduce costs and act as an effective fraud prevention tool, just over a third of global respondents (36%), and under a third of LATAM respondents (30%) said they were currently using AI to fight fraud. Interestingly, however, LATAM operators appear to be more forward-thinking regarding the implementation of AI-based tools in the next 12 months, with 50% saying they have plans to implement vs just 37.70% of global respondents.

The extensive consultation periods on Brazil’s gambling regulations, and on the technical, payment and security requirements operators must follow (including geolocation requirements) clearly shows that LATAM operators are taking the threat of fraud very seriously.

Operators be warned: if you’re not taking advantage of the benefits of AI-based tools to enhance your identity verification efforts, or bolster your fraud-prevention arsenal, then know that fraudsters are probably using them to attack you.

“While in the past, cybercriminals needed a certain base level of technical skills to produce fake documents or websites, AI-augmented fraudsters can utilize generative AI to create authentic-looking documents, videos, images and audio,” said Lovro Persen, Director of Document and Fraud at IDnow.

Of course, the other major use case for implementing AI tools is to aid with huge volumes of new customers.

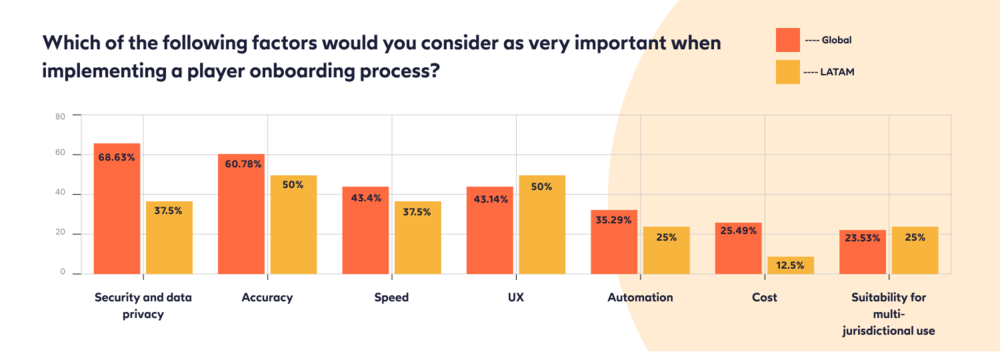

“Onboarding is the most crucial stage of the customer journey, so it should be as seamless as possible. While the above data speaks to the myriads of different components that operators deem as ‘very important,’ it also reveals some interesting difference between the priorities of global and LATAM operators.

“For example, almost 7 out of 10 global respondents agreed that ‘Security and data privacy’ was very important, but only 37.5% of LATAM respondents agreed. A similar disparity was also seen for ‘Cost’, with almost double the number of global respondents (25.49%) citing it as a very important factor compared to LATAM respondents (12.5%),” said Ronaldo.

Clearly, LATAM operators are prepared to make the necessary financial investment and although concerned about security and data privacy, remain less so than their global counterparts, suggesting they are eager to enter the market and participate by any means necessary.

Get onboard. Pick-ups and drop-offs.

While global operators believed there were a variety of reasons that customers abandoned onboarding, including Registration; Document Verification; Selfie Checks and Document Submission, the only area that appears to be a cause for concern for LATAM operators is ‘Document submission.’ In the ‘Challenges in Compliance Survey,’ we separated Document submission into two categories: a) including personal information; bank statements; utility bills (Global: 50.98% LATAM: 62.5%) and ‘b: ID documents (Global: 13.73% LATAM: 37.5%).

The two most common other factors that deter players from completing onboarding were an ‘Extensive KYC process’ (Global: 60.78% LATAM: 100%) and a ‘Complex and lengthy registration’ (Global: 54.90% LATAM: 75%).

All onboard: All eyes on Brazil.

The grey areas in which many LATAM countries’ gambling communities exist has meant that onboarding processes have historically either been non-existent or light touch; perhaps requiring players to just submit a name and address. As KYC and identity verification is the cornerstone of any trustworthy customer-business relationship within a regulated market, this will change dramatically. In the highly anticipated market of Brazil, for example, onboarding will become more complex than it’s ever been. Practically overnight (likely one night at the end of 2024), operators will be required to perform a three-step identification process, each of which carries a unique challenge.

Due to each Brazilian region having its own form of identity document, operators will need the capability to process a wide range of different documents

Another requirement for operators is the ability to verify citizens’ Cadastro de Pessoas Físicas (Natural Persons Register) number

Biometric verification will also be mandated, with weekly facial reverifications to become a requirement

“Although such measures have long been in place for financial services, for many Brazilian gambling operators and players, these onboarding requirements will be completely new, so it’s important that operators are able to comply with regulations while still offering an attractive-enough user experience to ensure players migrate over from the grey market to the regulated market,” said Rayissa Armata, Director of Global Regulatory & Government Affairs at IDnow.

5 LATAM countries to place your bets on in 2025.

Brazil

Perhaps the LATAM market with the most potential, Brazil will roll out the particulars of its new gaming policies in a series of ordinances released in four phases throughout the coming months.

The first phase (featuring the technical, payment and security requirements operators must follow) wrapped at the end of the April. The remaining three stages will be held throughout May, June and July:

Stage two: AML/KYC and bettors’ rights;

Stage three: Technical and security standards and advertising;

Stage four: Industry contributions to social responsibility clauses;

As such, the Ministry of Finance will implement the approved sports betting by the end of July 2024, and operators will have six months to become compliant in order to participate in LATAM’s largest gambling market. Perhaps most eagerly anticipated, Brazil issued an ordinance on May 22 that allows operators to apply for licenses to offer sports betting and online gaming.

Peru

Peru has a long-standing relationship with gambling and is one of a few South American countries to have allowed local and international companies to operate online casinos and betting sites. In October 2023, Peru decided to introduce new gambling rules and licenses for local and international operators. Testament to the size of the market is the fact that Peru’s Ministry of Foreign Trade and Tourism received 145 requests for operator licences within the first 30 days. Read more about the gambling market in Peru in our blog, ‘Open for business: Understanding gambling regulation in Peru.’

Argentina

The LATAM country with perhaps the most confusing regulatory environment (and that’s saying something) is without doubt Argentina. The main cause of the confusion is the fact that Argentina does not have one national regulatory body, and instead cedes control to each of its 24 autonomous jurisdictions. As two thirds of jurisdictions have legalized gambling, it makes for 16 different regulatory regimes throughout the country. Although differences between regimes are negligible, operators need to ensure they comply with each and every requirement to serve different region’s customers.

It’s worth noting that Germany used to have a similar arrangement, with 16 different states offering unharmonized gaming requirements. Now that Germany has a central Gaming Authority operating under one gaming regime, the expectations are high that operators and gamers are moving away from the black market. Of course, it may take time to reap the benefits of a harmonized regime but considering stricter global requirements on Anti-Money Laundering and the roll out of digital identities, new regulations and digital services are here to stay.

Chile

In Chile, it’s not a question of ‘Will they?’ but more a case of ‘When will they?’ finally pass gambling regulation. Like many LATAM countries, until that happens, offshore operators have stepped into the void, circumnavigating domestic regulatory restrictions to offer gambling services to Chilean players. This will all be set to change when the Senate finally gives the green light to regulations. As said, when that will be is anyone’s guess (it was supposed to be finalized by 2023), but it is likely to be later this year or early 2025. For now, and for Chile’s Senate and National Congress, it’s back to the drawing board to find a resolution, in particular, regarding the legal status of operators currently offering services.

Colombia

In Colombia, the GGR generated from online gambling exceeded $56 million in 2022. The industry is regulated as part of the Columbian Gambling Act 2002, which organizes the administration and control of the industry at both national and regional level. In this regard, the gaming industry in Colombia is considered a monopoly.

Play on with IDnow.

Discover how seamless player verification enhances online gaming security, fostering trust and helping you meet the compliance challenge in any region. With IDnow, you can fight bonus abuse, safeguard against underage gambling and comply with local and global gambling regulations – without adding friction or impacting user experience.

Source: IDnow

Edited by: @MaiaDigital www.zonadeazar.com