Zona de Azar Israel – Optimove: What Insights Does NFL Bettor Behavior Provide for Sportsbook Operators?

Israel.- 23th January 2024 www.zonadeazar.com In 2023, marketing fatigue became identified as a prevailing challenge for marketers.

Israel.- 23th January 2024 www.zonadeazar.com In 2023, marketing fatigue became identified as a prevailing challenge for marketers.

Optimove’s 2023 surveys highlight its impact on consumers and actions marketers can take now

Why it Matters:

As iGaming operators plan for the playoffs’ kickoff, understanding the player lifecycle stage (new-> activated-> churned -> reactivated) is a critical step in personalization.

It empowers the operator to address players with highly relevant content based on their engagement history with your brand.

Optimove analyzed sportsbook players’ behavior based on an analysis of over 10 million bets from September 2022 to February 2023 comparing the NFL Regular season to the Playoffs and Super Bowl.

This Optimove Professional Services Consolidated Sportsbook Player Data can guide iGaming operators during the 2023/2024 NFL playoffs.

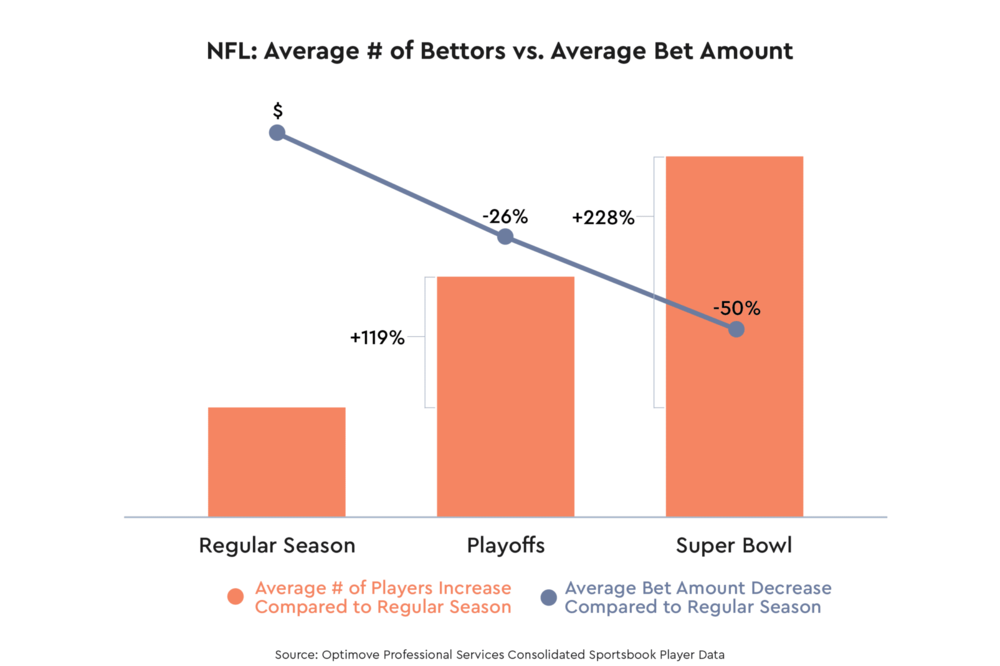

Our data shows that the volume of bets increases as the average bet amount declines based on the importance of the game. It indicates that sportsbooks can use this spike in player activity to entice new regular players.

Separately, according to the Optimove 2023-2024 Report on NFL Wagering, NFL bettors find personalized messages from their sports betting sites valuable, with 65% perceiving the messages as personalized.

Also, operators should note that the beginning of an NFL season, the playoffs, and the Super Bowl are spikes when they will have new players. Many of these first-time depositors may need guidance in placing their first bet. It is a key first step to assuring excellent player Journey Orchestration. To learn more about who these potential new players are so you can activate them, download our Lifecycle Guide of iGaming Operators.

Key Data from More than 10 Million Bets

An Increase in the Average Daily Number of Players and a Decrease in the Daily Average Bet Amount

Our Professional Services Consolidated Sportsbook Player Data revealed that the average daily bet amount per player (bettor) on playoff games was 26% less than it was during regular season games. And the average bet amount Super Bowl game day was 50% (half) of the regular season.

Compared to the regular season, there were 119% more players (bettors) in the playoffs and 228% more for the Super Bowl. It indicates that many new players placing smaller bets were eager to participate in the action of big games. For sportsbooks, most of these “new” players are one and done, but for those who plan accordingly, these new players can be retained, becoming recurring, profitable customers.

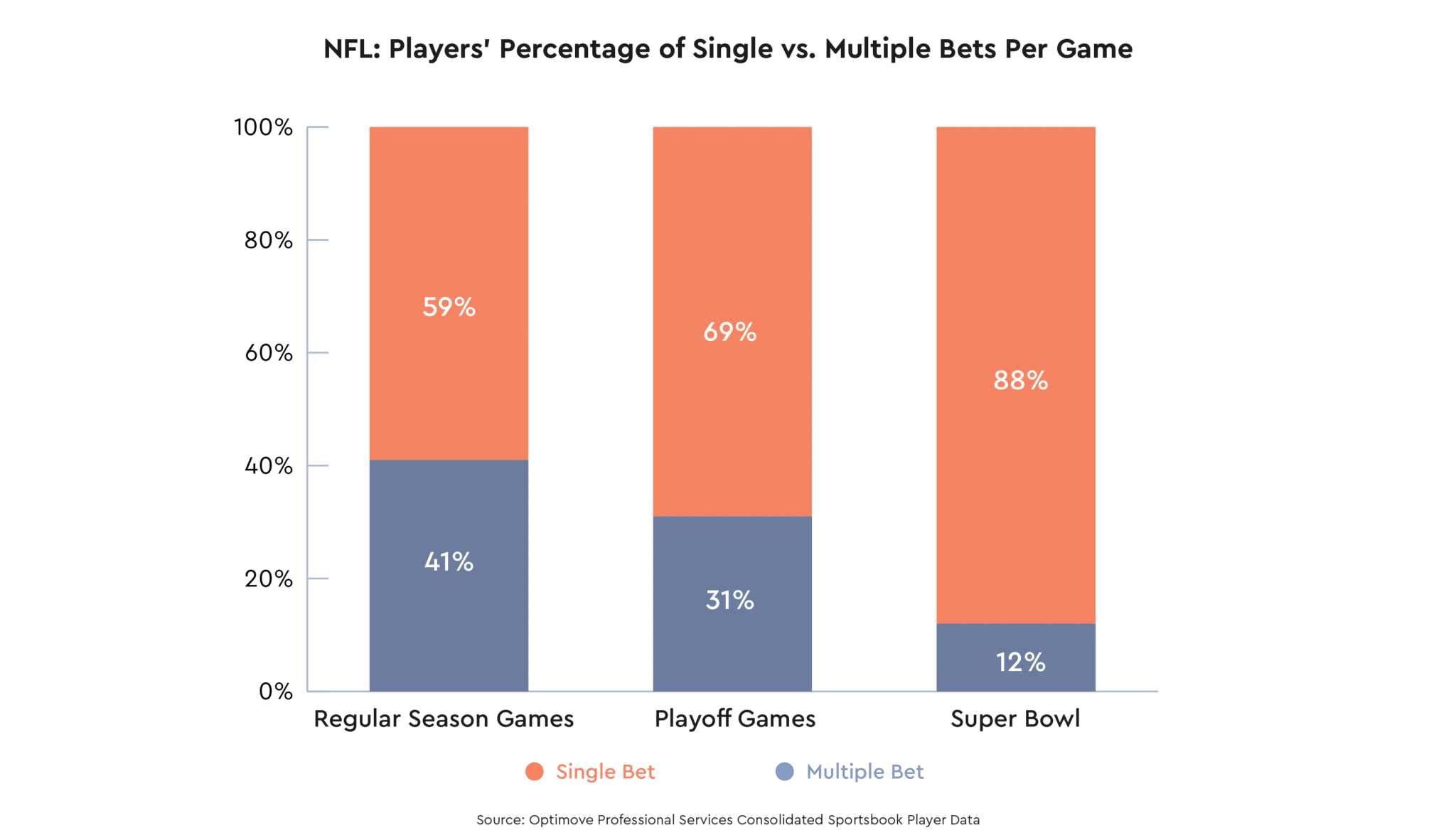

More sophisticated betting options, like parlays, are less likely to be used by new bettors. Simple bet recommendations are more likely to be entertained by this “new” group. (see chart below)

Separately, the Optimove 2023-2024 Report on NFL Wagering found that the top anticipated bet types are point spread (62%), over/under (53%), and moneyline (46%). Results from that report also reveal that live bets during the game are a common practice, with 61% of respondents engaging in this form of betting.

Trends of first-time depositors (players); what about their retention?

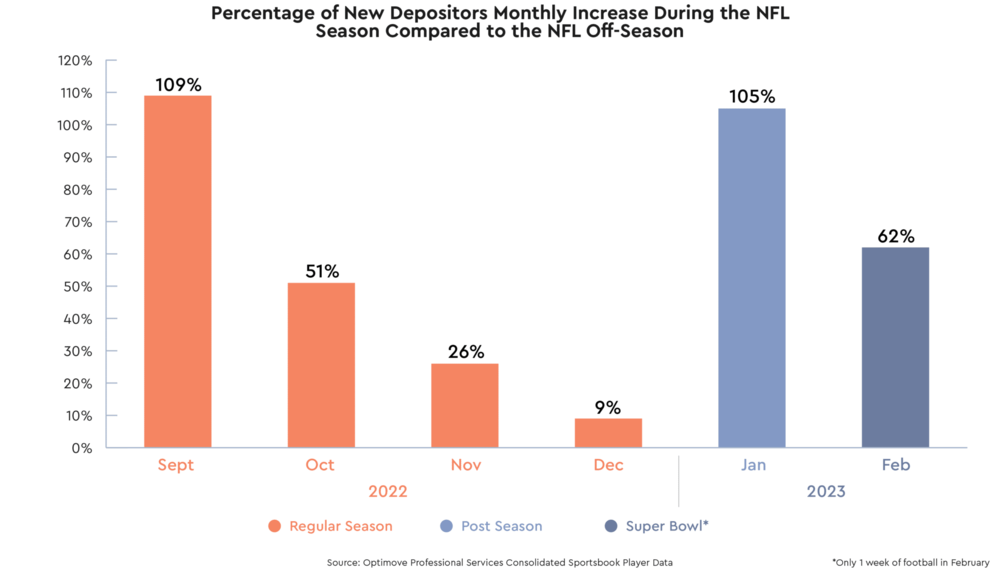

Like every big sport event, the NFL brings a lot of new depositors (players), individuals who place an initial amount of money in an account. Throughout the NFL season, we observed an increase in the monthly average number of first-time depositors compared to the average over the previous six months without football. (Percentage of New Depositors Monthly Increase During the NFL Season Compared to the NFL Off-Season.)

In September, the increase over the previous six-month average of first-time players was 109%, in October 51%, in November 26%, and December, at the end of the regular season, 9%. However, January, the month at the inception of the playoffs, the increase was 105%, and the month of February was a 62% increase (although there was only 1 week of football, the Super Bowl). (see chart below)

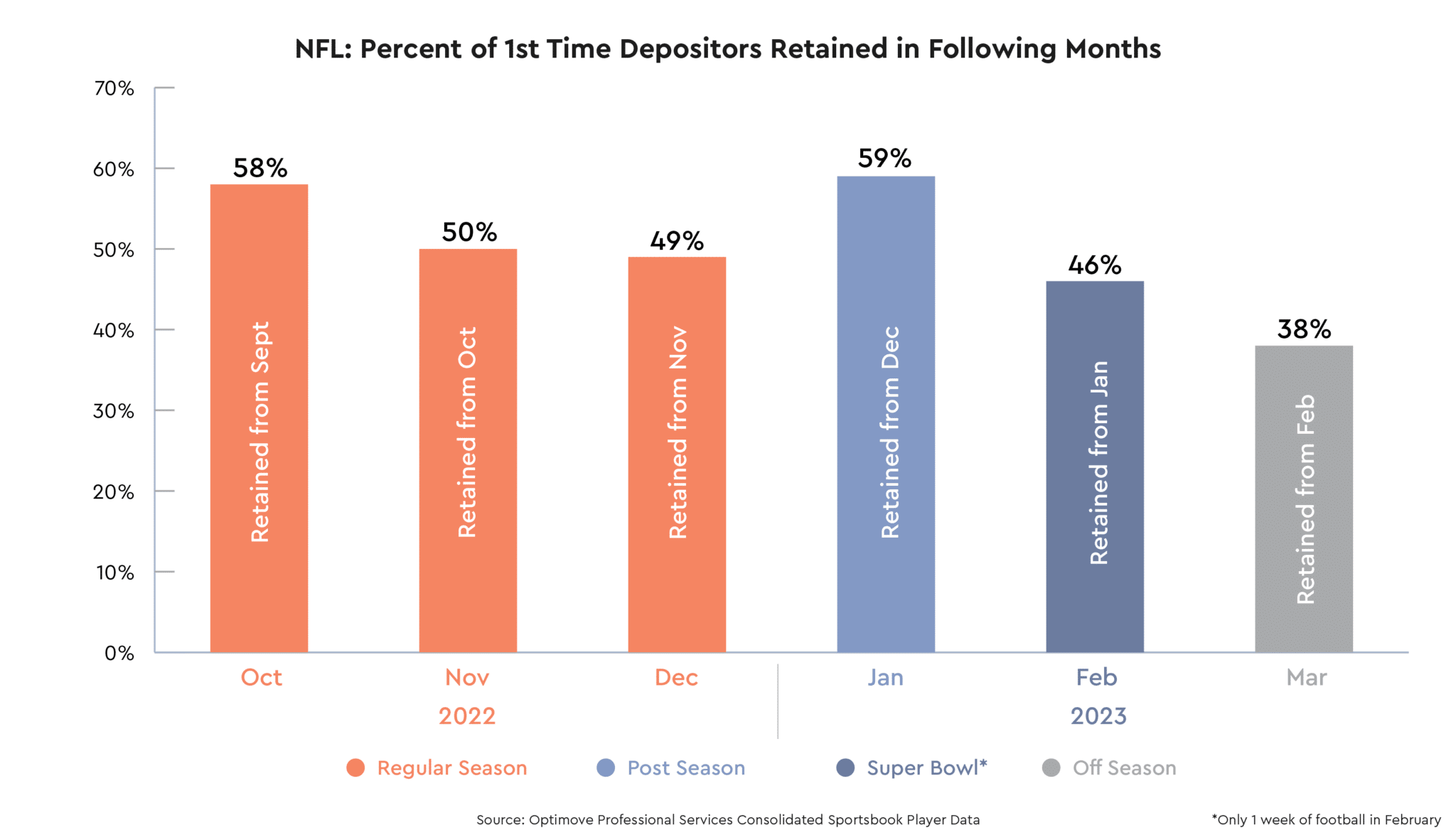

Our Professional Services Consolidated Sportsbook Player Data also revealed the retention rate for first-time depositors decreased the subsequent month over the regular season with a spike of retention in January, playoff month. Of first-time depositors in September, fifty-eight percent (58%) were retained as active in October.

In November and December about half were retained as active from the previous month. In January (playoff month) 59% of the new depositors remained active from December, and in February 46% were retained from January. In March, 38% were retained from February, even as the NFL season ended, indicating that operators found new games to entice bettors, perhaps March Madness. (see chart below)

Single Bet vs. Multi Bets Per Game

When it comes to betting preferences, our data indicates that players tend to favor single bets, and this tendency increases as the Super Bowl approaches. This trend reflects a desire among players for simplicity and a preference for straightforward bets as more new players engage in the NFL sportsbook.

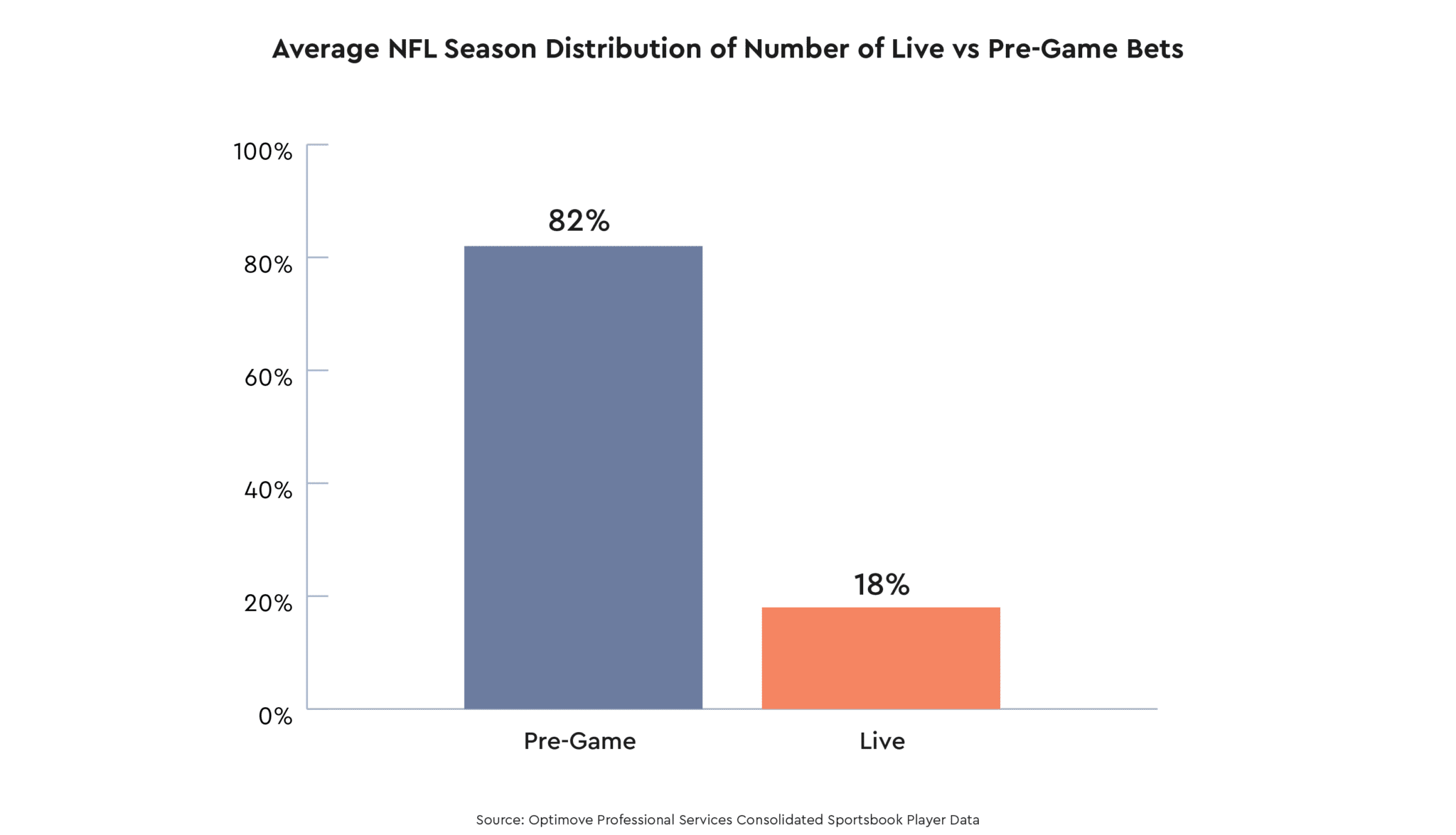

Players Who Place Live Bets, Wager More

Live bets, as a game is in progress, are a significant aspect of sports gaming, and our analysis revealed some interesting patterns. We found that 82% of players preferred to place their bets on pregame bets over the season, leaving only 18% making live bets. However, the average bet amount for live bets was 1.6 times higher than pregame tickets indicating that the more seasoned players make these higher wagers.

Conclusion

Understanding the player lifecycle stage (new-> activated-> churned -> reactivated) is a critical step in personalization for sportsbook operators. It empowers the operator to address players with highly relevant content based on their engagement history with your brand. It is an opportunity to acquire new players and reactivate dormant ones.

Edited by: @MaiaDigital www.zonadeazar.com